What is the Blockchain Trilemma? Understanding the Trade-Offs in Blockchain Technology

The blockchain trilemma refers to the challenge of balancing decentralization, security, and scalability. In this article, we explore the trade-offs and innovations that address these challenges.

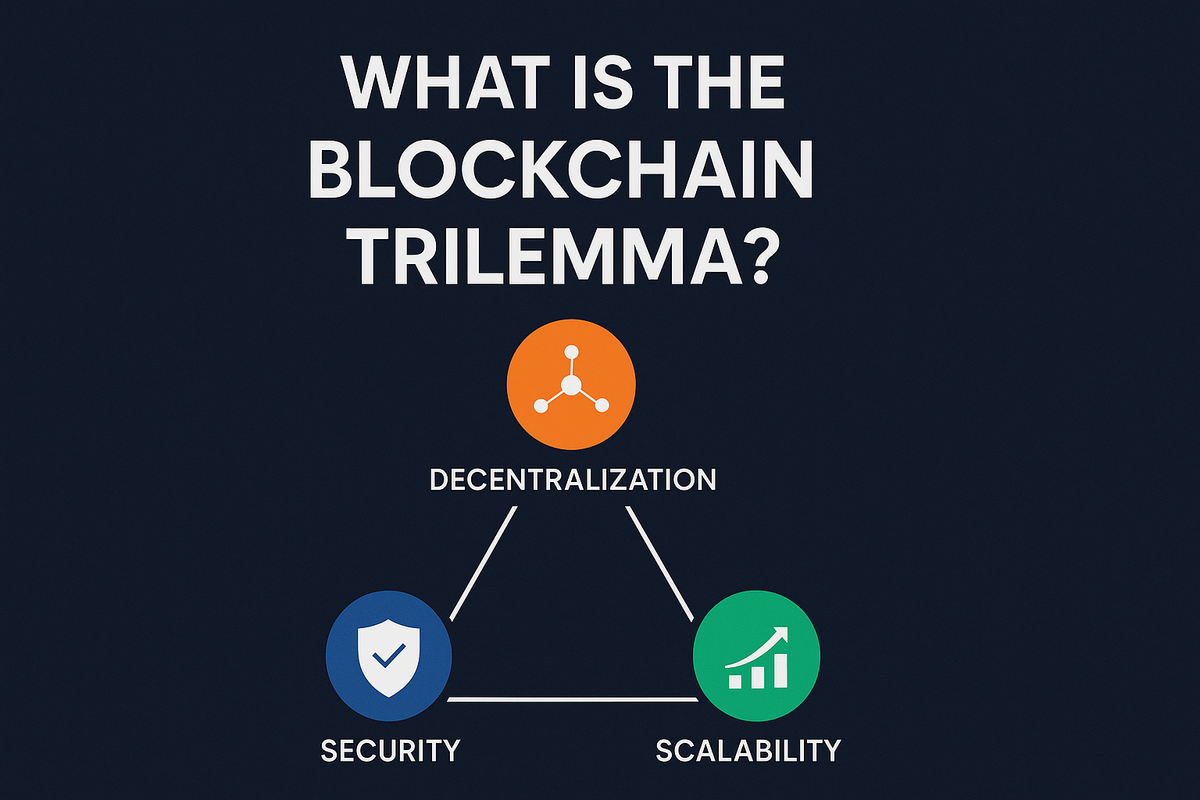

The blockchain trilemma refers to the challenge of balancing three crucial attributes of blockchain technology: decentralization, security, and scalability. While these pillars are essential for blockchain’s success, achieving all three simultaneously is incredibly difficult. Developers and innovators often face trade-offs between them, as improving one factor can negatively impact the others. Understanding the blockchain trilemma is crucial for anyone involved in blockchain development or interested in the future of decentralized technologies.

In this article, we’ll explore what the blockchain trilemma is, why it’s so challenging, and how current blockchain projects are dealing with it. We’ll also take a look at real-world examples and innovative solutions designed to overcome these hurdles, shedding light on the direction of blockchain technology.

Let’s dive deeper into how decentralization, security, and scalability intersect and create the trilemma that blockchain developers constantly try to solve.

What Is the Blockchain Trilemma?

The blockchain trilemma, a term popularized by Ethereum creator Vitalik Buterin, describes the inherent challenges of designing a blockchain that achieves a balance between three key elements: decentralization, security, and scalability. Each of these pillars is vital to the success and adoption of blockchain technologies, yet they often come into conflict.

- Decentralization ensures that no single entity has control over the blockchain. This is essential for maintaining trust and allowing users to participate in the network freely. However, achieving full decentralization can slow down the system and hinder its ability to scale efficiently.

- Security is crucial to protect the network from malicious attacks and ensure data integrity. A secure blockchain ensures that all transactions are valid and transparent, but over-prioritizing security can lead to slower transaction processing times and reduced scalability.

- Scalability refers to a blockchain’s ability to handle a growing number of users and transactions without compromising performance. Scalability is often sacrificed to maintain decentralization and security, as more decentralized or secure blockchains may have limited throughput.

The blockchain trilemma arises because these three goals often conflict. For instance, if a blockchain prioritizes decentralization and security, it may struggle to scale. On the other hand, focusing on scalability can reduce security or lead to centralization.

In the next section, we’ll explore these three pillars in more detail and examine how they impact one another.

The Three Pillars: Decentralization, Security, Scalability

The blockchain trilemma is composed of three crucial pillars: decentralization, security, and scalability. These elements are interconnected, and the trade-offs between them are what create the trilemma. Let’s break each of them down:

1. Decentralization

Decentralization is a foundational principle of blockchain technology. It ensures that control over the network is distributed across many nodes, rather than being concentrated in the hands of a few entities. This makes the blockchain more resistant to censorship and manipulation, as there is no single point of failure.

A decentralized network enhances trust, as users don’t need to rely on a central authority to validate transactions. It also allows anyone to participate in the blockchain, which is a core feature of public blockchains like Bitcoin and Ethereum.

However, decentralization often comes with a trade-off. The more decentralized a network is, the more complex and resource-intensive the consensus mechanism becomes. This can limit the network’s scalability and performance.

2. Security

Security is one of the most important aspects of blockchain technology. It ensures that all transactions are tamper-proof and resistant to attacks, providing users with confidence in the network’s integrity. A secure blockchain network prevents double-spending, fraud, and hacking attempts.

The security of a blockchain relies on its consensus mechanism (e.g., proof-of-work for Bitcoin, proof-of-stake for Ethereum 2.0) and its cryptographic algorithms, which make it incredibly difficult for malicious actors to alter transaction data.

However, improving security can come at the expense of scalability. For example, adding complex cryptographic features or tightening validation requirements can slow down transaction processing, making the blockchain less scalable. In some cases, security measures can also make the blockchain more centralized, as they require significant computational resources or specialized hardware to maintain.

3. Scalability

Scalability refers to the blockchain’s ability to process a high volume of transactions quickly and efficiently. For blockchain networks to compete with traditional financial systems, they need to handle thousands or even millions of transactions per second (TPS). Unfortunately, this is one area where most blockchains struggle.

As blockchains grow in popularity, the volume of transactions increases, and scalability becomes an issue. Traditional blockchains like Bitcoin and Ethereum are limited in terms of TPS because of their decentralized nature and the time required for consensus to be reached. As more transactions are added, the network can become congested, leading to slower confirmation times and higher transaction fees.

To improve scalability, various solutions have been proposed, such as sharding, Layer 2 scaling solutions, and alternative consensus mechanisms. However, each solution brings its own challenges and trade-offs related to decentralization and security.

Real-World Examples and Trade-Offs

Real-world blockchain platforms provide valuable insights into how the blockchain trilemma plays out in practice. Let’s examine three prominent blockchains—Bitcoin, Ethereum, and Solana—and explore how they approach the challenge of balancing decentralization, security, and scalability.

1. Bitcoin

Bitcoin, the first and most well-known blockchain, prioritizes decentralization and security above all else. Its proof-of-work consensus mechanism ensures that no single entity can control the network, and it has proven to be incredibly secure, as evidenced by over a decade of operation without major breaches.

However, Bitcoin sacrifices scalability. The network can only process a limited number of transactions per second (approximately 7 TPS), which makes it less suitable for high-volume applications compared to traditional payment systems like Visa. While Bitcoin’s focus on decentralization and security ensures trust, it limits the blockchain's scalability.

2. Ethereum

Ethereum, the second-largest blockchain by market cap, faces similar challenges but has made strides toward improving scalability. Initially using proof-of-work (like Bitcoin), Ethereum’s network struggled with congestion and high gas fees. However, with the transition to Ethereum 2.0 and the implementation of proof-of-stake, Ethereum aims to improve scalability while maintaining its decentralized and secure nature.

Ethereum also utilizes Layer 2 solutions like Optimistic Rollups and zk-Rollups, which help scale the network by processing transactions off-chain. While this improves scalability, it’s a delicate balance, as scaling solutions can complicate security and decentralization.

3. Solana

Solana takes a different approach by prioritizing scalability. Its high-speed blockchain boasts an impressive transaction throughput (over 65,000 TPS), making it one of the fastest platforms available. However, this emphasis on scalability leads to concerns about centralization—Solana’s consensus mechanism and hardware requirements limit its decentralization, as fewer entities can participate in the validation process.

Solutions and Innovations

Blockchain developers are constantly working on innovative solutions to mitigate the challenges posed by the trilemma. While the ideal blockchain that perfectly balances decentralization, security, and scalability remains elusive, several promising approaches are emerging.

1. Layer 2 Solutions

Layer 2 solutions are protocols built on top of a base blockchain (Layer 1) to enhance scalability. Examples include the Lightning Network for Bitcoin and Optimistic Rollups for Ethereum. These solutions process transactions off-chain and then settle them on the main blockchain, significantly reducing congestion and improving transaction speed without compromising decentralization or security. Layer 2 networks are particularly effective in scaling blockchain networks while keeping the foundational blockchain secure and decentralized.

2. Sharding

Sharding is another method to improve scalability by breaking the blockchain into smaller, more manageable pieces, or "shards," each capable of processing transactions in parallel. This approach, adopted by Ethereum 2.0, allows multiple transaction sets to be processed simultaneously, significantly increasing throughput. While sharding enhances scalability, it can introduce challenges related to security and data consistency across the shards.

3. Alternative Consensus Mechanisms

Proof-of-stake and other alternative consensus mechanisms, such as delegated proof-of-stake (DPoS) and proof-of-authority (PoA), aim to increase scalability by reducing the energy requirements and computational demands of traditional proof-of-work (PoW) systems. These mechanisms allow for faster transaction processing, but may introduce centralization risks, as they often rely on a smaller group of validators.

Blockchain Trilemma FAQ

The blockchain trilemma refers to the challenge of balancing three key elements: decentralization, security, and scalability, which often conflict with each other in blockchain design.

Decentralization ensures that no single entity controls the network, promoting trust and transparency while preventing censorship or manipulation.

Sharding divides the blockchain into smaller pieces, allowing them to process transactions in parallel, which significantly increases throughput and scalability.

Layer 2 solutions, like the Lightning Network, enable faster and cheaper transactions by processing them off-chain and then settling them on the main blockchain.

Yes, Solana can process over 65,000 transactions per second, far surpassing Bitcoin’s 7 transactions per second, but it sacrifices decentralization for scalability.

Conclusion

The blockchain trilemma is a central challenge for developers building decentralized technologies. Balancing decentralization, security, and scalability remains a complex task, with no one-size-fits-all solution. While projects like Bitcoin and Ethereum prioritize security and decentralization, newer blockchains like Solana focus on scalability.

Innovations such as Layer 2 solutions, sharding, and alternative consensus mechanisms are making progress toward overcoming these limitations, but trade-offs will always exist. The blockchain community will continue to evolve, striving for new methods to achieve an optimal balance and push the technology forward.