What Are Meme Coins? Inside the Internet’s Wildest Crypto Trend

Meme coins are crypto tokens born from internet humor — but don't let the jokes fool you. Learn what they are, how they rise, and the risks behind the memes.

Meme coins have taken the crypto world by storm, captivating both seasoned investors and casual observers with their quirky origins and explosive price movements. Unlike traditional cryptocurrencies built with clear technical use cases, meme coins often begin as jokes or internet trends — yet some have reached billion-dollar market capitalizations. Their rise is closely tied to online culture, social media virality, and a community-driven spirit that prioritizes fun over fundamentals.

While many dismiss meme coins as frivolous or purely speculative, others see them as a reflection of the democratization of finance — a place where anyone, regardless of background, can participate, experiment, and even strike it rich. But behind the humor and hype lies a complex and volatile landscape where fortunes are made and lost in days.

In this article, we’ll explore what meme coins are, how they came to be, what drives their popularity, and what risks (and opportunities) they present. Whether you’re a curious newcomer or a crypto veteran, understanding meme coins is essential to grasping one of the most unpredictable and entertaining corners of Web3.

What Are Meme Coins?

Meme coins are a type of cryptocurrency inspired by internet jokes, pop culture references, or viral content. Unlike Bitcoin or Ethereum, which were created to solve specific problems like decentralized payments or smart contract execution, meme coins typically have little to no inherent utility. Their primary appeal lies in their humor, relatability, and community engagement.

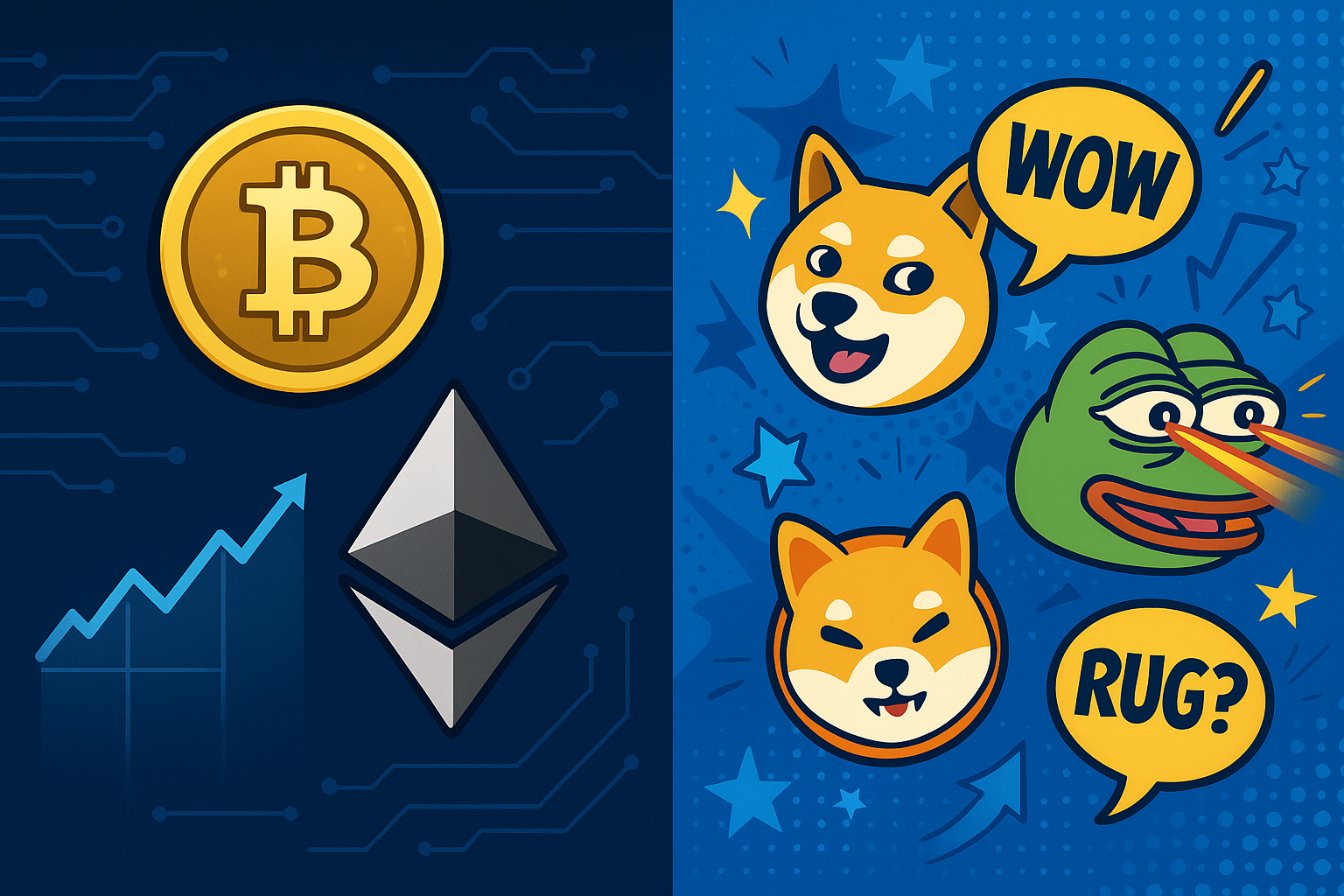

These tokens are often launched as parodies or experiments, but some gain significant traction thanks to viral marketing, influencer support, and highly active online communities. Dogecoin, the first and most famous meme coin, started as a joke in 2013, featuring the Shiba Inu dog from the “Doge” meme. Despite its origins, Dogecoin eventually reached a market cap of tens of billions of dollars — largely due to social media hype and high-profile endorsements, including from Elon Musk.

Meme coins are usually built on existing blockchain platforms like Ethereum or Binance Smart Chain, making them easy to create and distribute. Many lack a capped supply or well-defined development roadmap, which adds to their volatility.

While critics argue that meme coins are speculative bubbles with no real value, their defenders point to the power of collective enthusiasm and the role of memes in shaping internet culture. In essence, meme coins represent a fusion of finance, entertainment, and community-driven hype — a financial phenomenon unlike anything seen before.

Origins and Evolution

The story of meme coins begins with Dogecoin — a lighthearted cryptocurrency launched in December 2013 by software engineers Billy Markus and Jackson Palmer. Inspired by the popular “Doge” meme featuring a Shiba Inu dog with Comic Sans captions, Dogecoin was never meant to be taken seriously. Its creators openly mocked the increasingly serious and speculative tone of the crypto space.

Despite its humorous origin, Dogecoin quickly attracted a loyal online community that used it for tipping content creators, donating to charitable causes, and sponsoring events like NASCAR races. Its low price and abundant supply made it ideal for microtransactions and internet tipping — a use case that helped it gain traction.

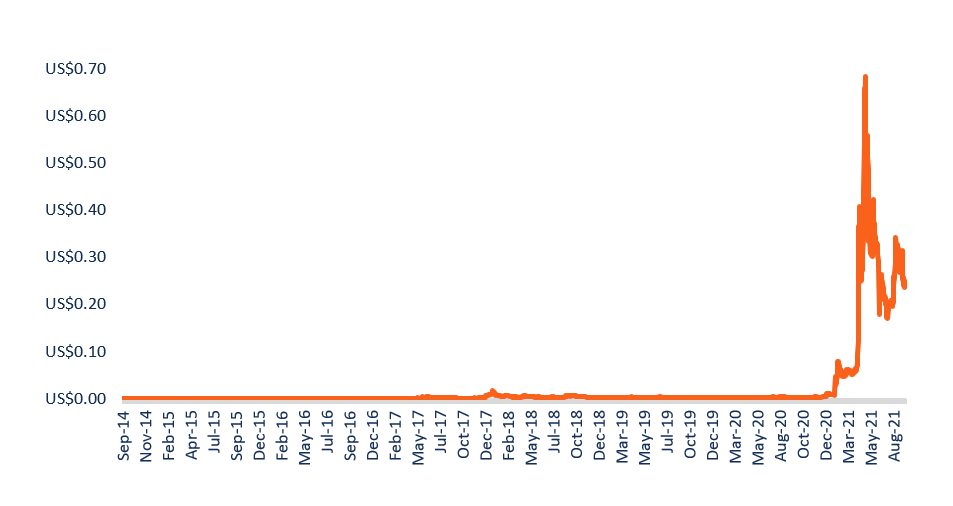

For years, Dogecoin remained a niche oddity. That changed in 2020 and 2021, when retail investors, Reddit communities, and celebrities — most notably Elon Musk — began championing it. Tweets from Musk sent DOGE’s price soaring, sparking renewed interest in meme coins as a whole.

This resurgence led to a wave of new meme coins, each attempting to capture the magic of Dogecoin with its own brand of internet humor. Shiba Inu (SHIB), Floki Inu, and later Pepe (PEPE) became some of the most prominent entries in this new generation, each building cult-like followings.

From parody to billion-dollar assets, the evolution of meme coins illustrates how internet culture and financial speculation can collide — and occasionally create viral wealth in the process.

Cultural Impact and Community

Meme coins thrive on culture — not code. Their success depends less on technical innovation and more on their ability to capture attention, spark laughter, and rally communities around a shared joke or identity. This makes meme coins a distinctly Web3 phenomenon, where online tribalism and virality drive financial outcomes.

Platforms like Twitter (X), Reddit, and Telegram play a crucial role in shaping meme coin narratives. Memes, GIFs, and inside jokes spread rapidly, turning obscure tokens into trending topics overnight. A well-timed meme or tweet can send prices skyrocketing — or plummeting — in a matter of hours.

Community is everything. Investors in meme coins often refer to themselves as part of a “family” or “army,” celebrating wins together and enduring losses with the same meme-fueled optimism. This emotional connection makes meme coin communities uniquely resilient, even in the face of market crashes or ridicule from mainstream media.

Meme coins also serve as a form of financial protest. For some, backing a meme coin is less about profit and more about challenging the seriousness of traditional finance — embracing chaos, humor, and irreverence as a form of empowerment.

Meme Coin Investment and Speculation

Investing in meme coins is a high-risk, high-reward game fueled more by sentiment than fundamentals. Unlike blue-chip cryptocurrencies like Bitcoin or Ethereum, most meme coins lack intrinsic utility, clear roadmaps, or established developer teams. Their value is driven almost entirely by hype, social media momentum, and the fear of missing out (FOMO).

This speculative nature creates opportunities for massive gains — and devastating losses. Early investors in Dogecoin and Shiba Inu saw astronomical returns during bull markets. However, those who bought near the top often experienced brutal drawdowns when the hype cycle faded. Prices can spike 10x in a week — and crash just as fast.

Retail investors are typically the main participants in meme coin frenzies. Many enter the market hoping to replicate past success stories, sometimes without fully understanding the risks involved. With minimal due diligence and the influence of meme culture, investing becomes more akin to gambling than strategic allocation.

Liquidity, tokenomics, and developer behavior also play major roles. Some meme coins have large pre-mines or developer wallets, leading to potential rug pulls or price manipulation. Others are abandoned shortly after launch, leaving holders with worthless tokens.

While meme coins can yield quick profits, they are not suitable for long-term, risk-averse investors. For those willing to embrace the chaos, however, they offer a unique — if volatile — path to potential upside.

Regulatory and Ethical Considerations

Meme coins exist in a regulatory gray zone. Because many are launched anonymously, lack transparency, and offer no clear utility, they often fall outside traditional financial frameworks — making them difficult to regulate effectively. This regulatory ambiguity has made meme coins a magnet for both speculative traders and bad actors.

One major ethical concern is the prevalence of pump-and-dump schemes. Some meme coins are created solely to generate hype, attract buyers, and allow early holders — often the developers themselves — to cash out before the price collapses. These so-called “rug pulls” are alarmingly common in the meme coin ecosystem.

Another issue is misinformation. Meme coin communities can aggressively promote unrealistic expectations, relying on viral marketing tactics and influencer endorsements that may mislead inexperienced investors. With few legal protections, retail buyers are often left holding worthless tokens when the hype fades.

Regulators in various countries, including the U.S. and EU, have started scrutinizing meme coins more closely. However, enforcement is challenging due to the decentralized and global nature of crypto. As the space matures, more oversight is likely — especially for coins that raise large amounts of capital or target mainstream investors.

Despite these concerns, the meme coin trend shows no signs of slowing — which makes understanding the risks more important than ever.

Notable Meme Coins Today

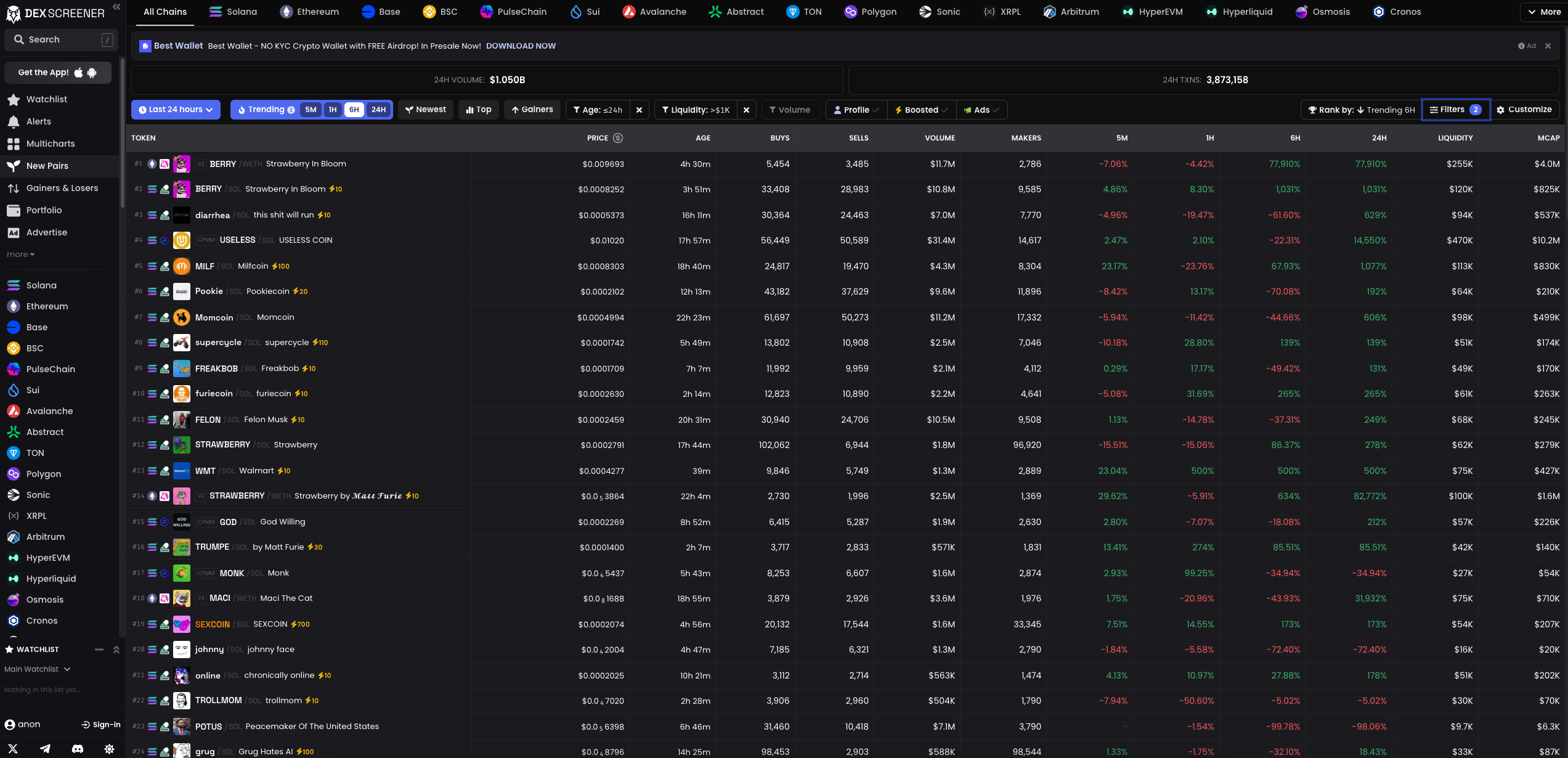

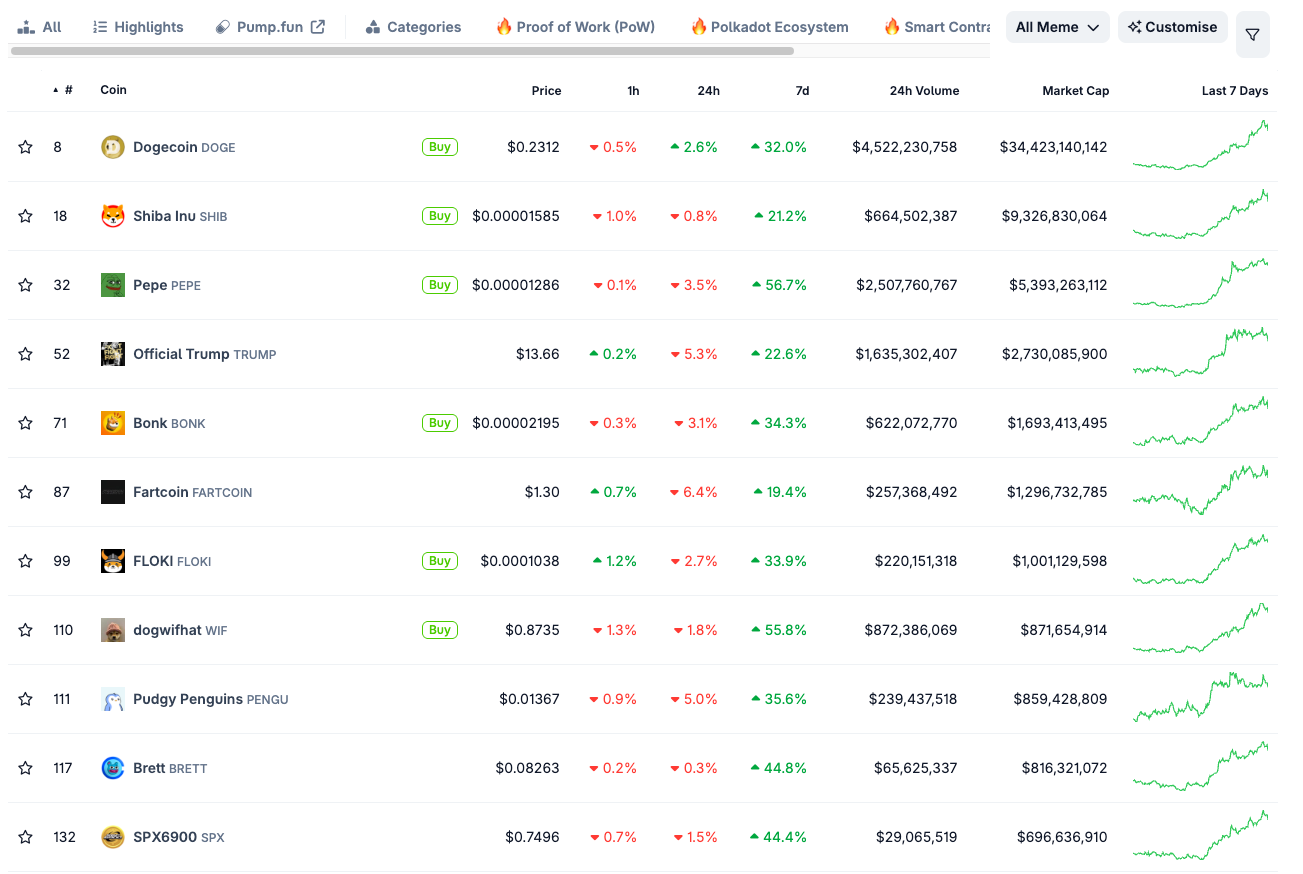

While thousands of meme coins exist, only a handful have risen to mainstream recognition. These tokens often reflect broader trends in internet culture and vary widely in purpose, tone, and community strength.

Dogecoin (DOGE) remains the king of meme coins. Created in 2013 as a joke, it became a cultural phenomenon thanks to its friendly branding and endorsements from figures like Elon Musk. Despite lacking smart contract functionality, Dogecoin reached a market cap of over $80 billion at its peak.

Shiba Inu (SHIB), launched in 2020, brands itself as the “Dogecoin killer.” Built on Ethereum, it offers more technical functionality than DOGE, including its own decentralized exchange (ShibaSwap) and plans for a broader ecosystem.

Pepe (PEPE) is a newer meme coin based on the infamous internet frog meme. It went viral in early 2023, attracting attention for its bold aesthetic and ultra-low market cap — a classic setup for speculative hype.

Floki Inu, Baby Doge, and Bonk are other notable meme coins that have cultivated passionate communities, unique branding, and ambitious roadmaps — even if their fundamentals remain questionable.

Each of these coins has ridden waves of speculation and social momentum, demonstrating that in the world of meme coins, branding and community often matter more than code.

The Future of Meme Coins

The future of meme coins is uncertain — and that’s part of their appeal. On one hand, they represent the chaotic energy of internet culture, rewarding early adopters and meme-savvy traders with explosive returns. On the other, they face mounting scrutiny from regulators, skeptics, and a maturing crypto industry that increasingly favors utility over hype.

Some meme coins are attempting to evolve beyond their origins. Projects like Shiba Inu and Floki Inu are building ecosystems with decentralized exchanges, metaverse integrations, and NFT platforms — moves intended to add long-term value and legitimacy. If successful, these efforts could help meme coins transition from jokes to viable assets.

At the same time, low barriers to entry mean meme coins will likely continue flooding the market, especially during bull runs. Many will fail or be forgotten, but a select few may capture the zeitgeist and explode in popularity — especially if backed by strong communities and viral narratives.

In the end, meme coins are likely to remain a persistent, if unpredictable, force in crypto. Whether viewed as financial satire, digital lottery tickets, or community-driven experiments, they embody a unique intersection of humor, speculation, and decentralized culture.

What Are Meme Coins? FAQ

A meme coin is a cryptocurrency inspired by internet jokes, memes, or trends. It typically gains popularity through viral marketing rather than technical innovation or utility.

Meme coins are highly speculative and volatile. While some investors profit during hype cycles, they also carry a high risk of loss and are not ideal for long-term investing.

Popular meme coins include Dogecoin (DOGE), Shiba Inu (SHIB), Pepe (PEPE), Floki Inu (FLOKI), and Bonk (BONK), each backed by active online communities.

Meme coins often go viral due to social media hype, influencer endorsements, and community-driven memes that rapidly attract attention and speculation.

Most meme coins are launched on existing blockchains like Ethereum or Solana. Developers can easily create tokens using smart contracts and promote them through online communities.

Yes, some meme coins are created solely for pump-and-dump schemes or rug pulls. Always research a project before investing and avoid tokens with anonymous teams or unclear goals.

Prices are primarily driven by hype, market sentiment, community engagement, and viral marketing. Fundamentals often play a minimal role in meme coin valuations.